November 2023 brought a mix of challenges and optimistic indicators to the Greater Toronto Area (GTA) real estate market, marking a moment of adaptation and resilience.

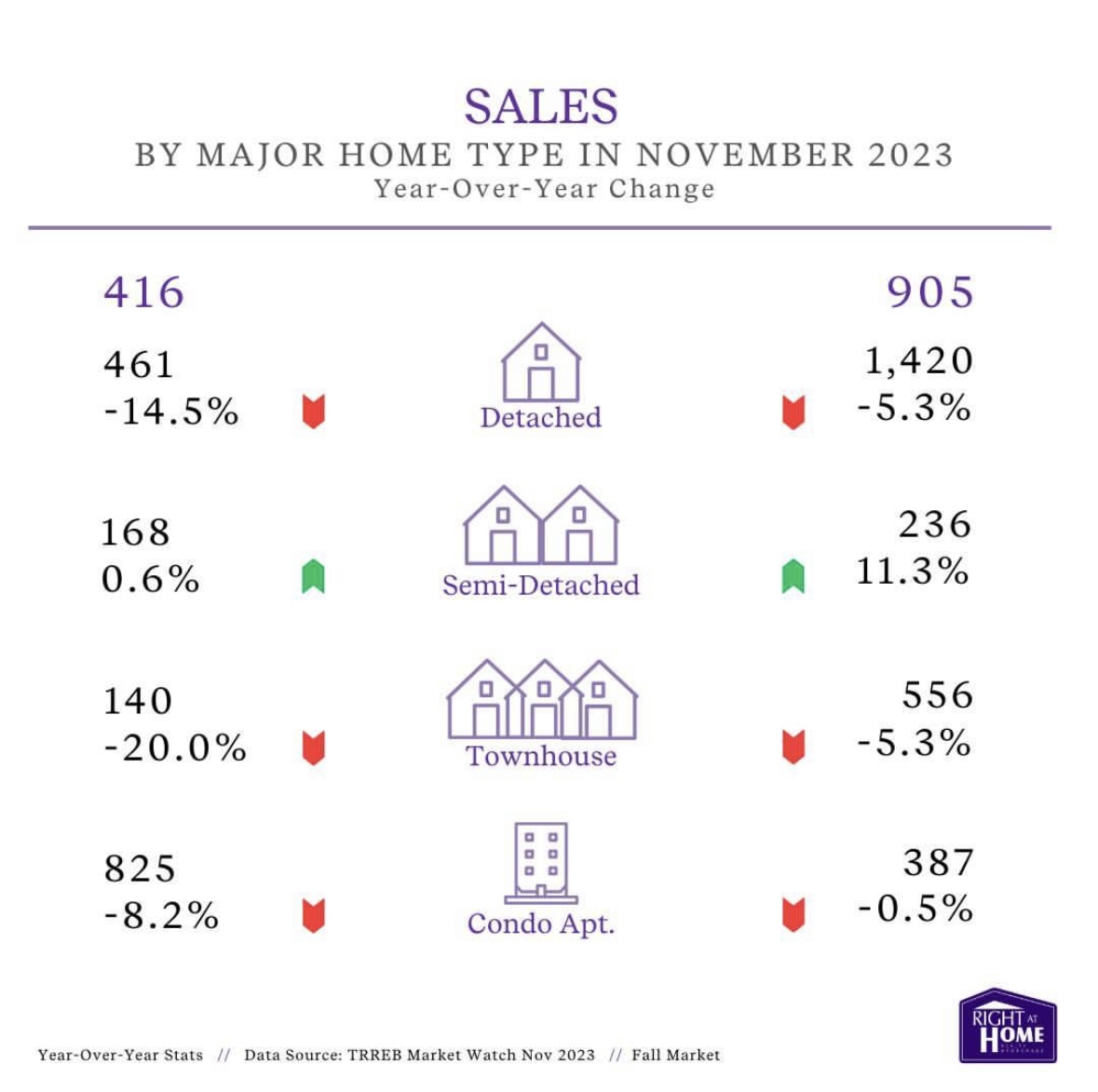

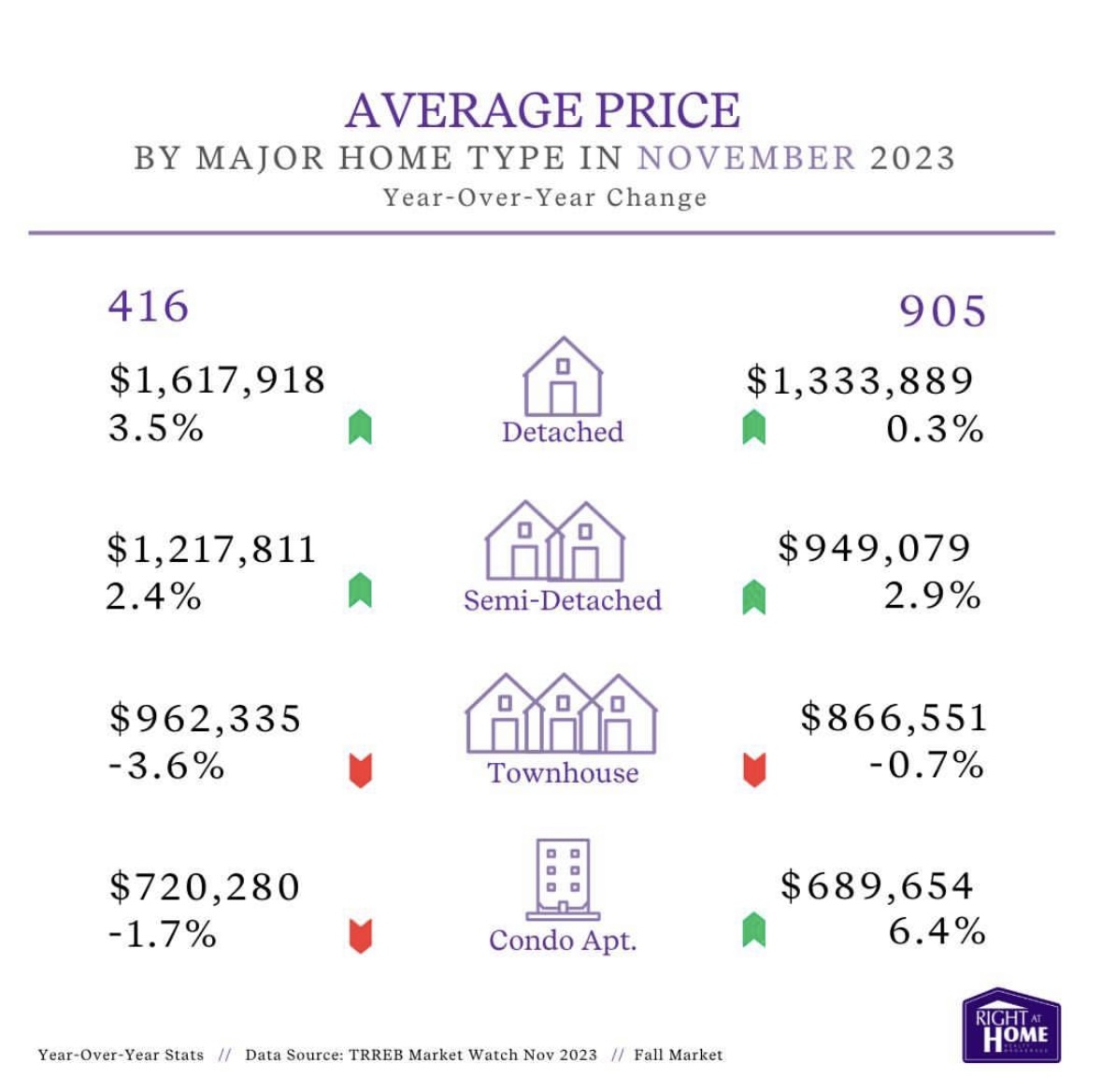

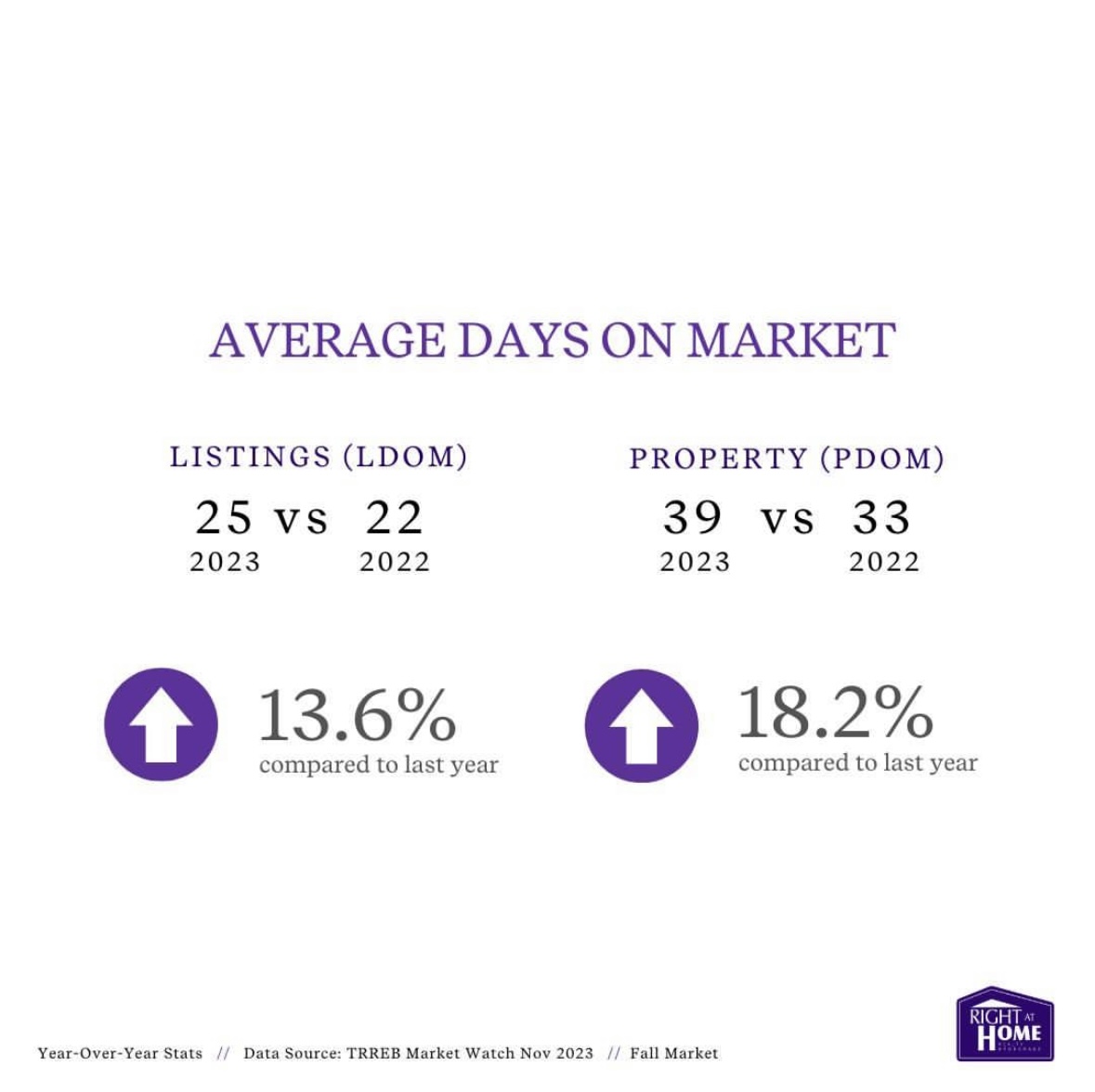

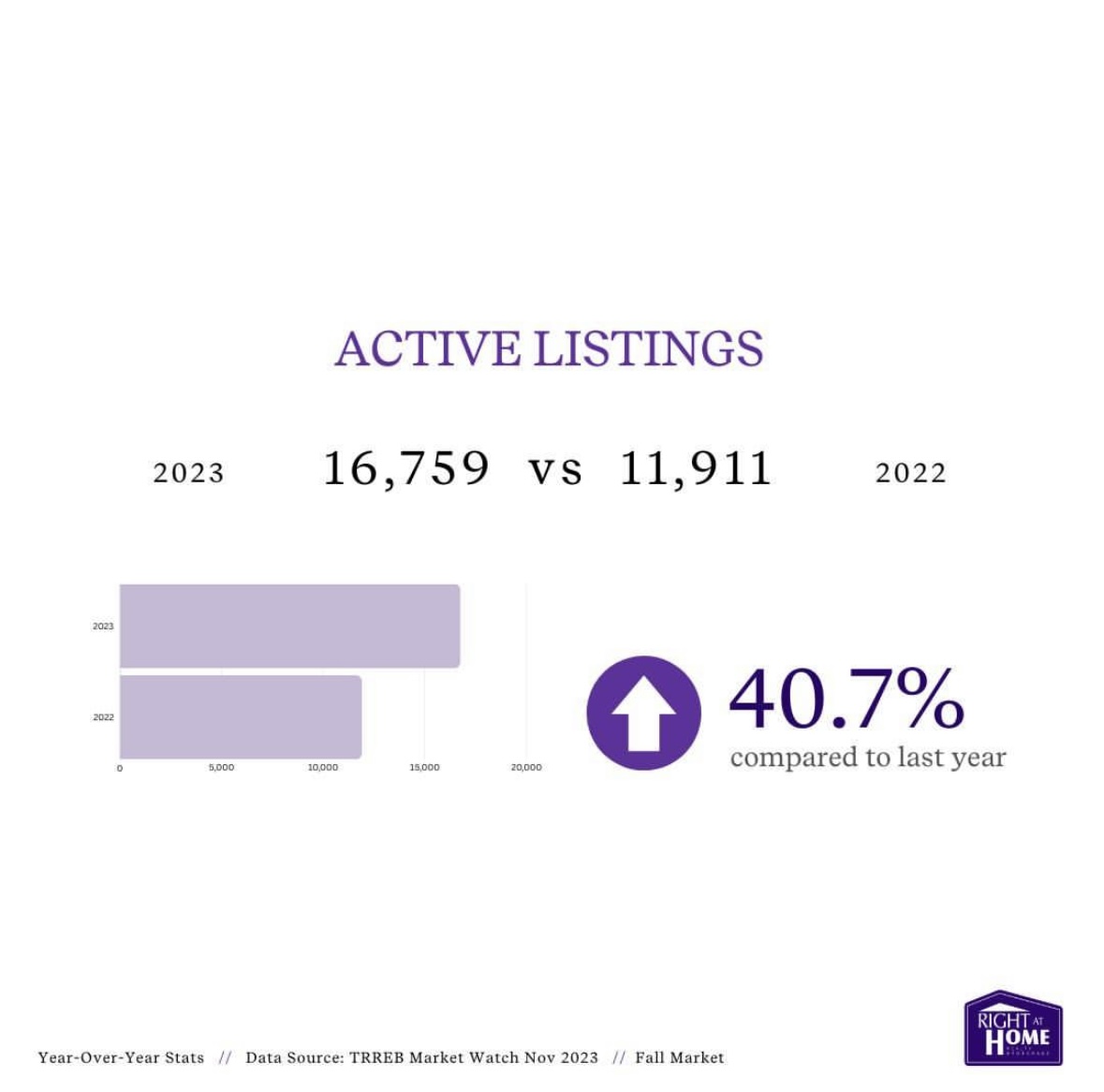

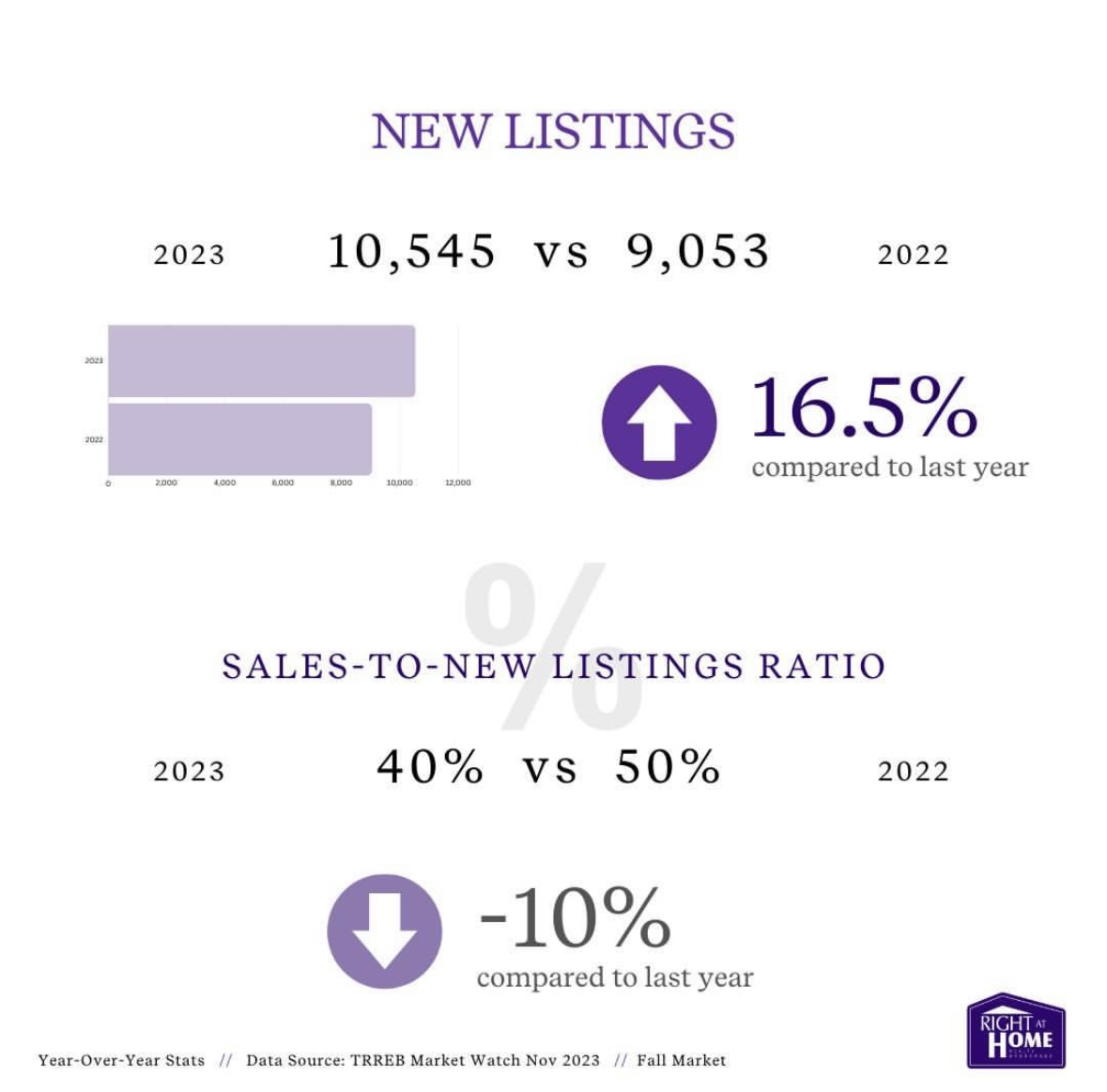

Sales dipped by six percent compared to November 2022, but this was accompanied by a 16.5 percent increase in new listings, providing a more diverse range of options for buyers. The MLS® Home Price Index Composite benchmark and the average selling price remained relatively stable, offering a balanced market for both buyers and sellers.

.

.

TRREB President Paul Baron noted the impact of inflation and borrowing costs on affordability, but he expressed optimism about future relief. Anticipated Bank of Canada rate cuts in the first half of 2024, coupled with lower bond yields, are expected to alleviate affordability concerns for existing homeowners and those entering the market.

Chief Market Analyst Jason Mercer highlighted that home prices have adjusted, providing relief for buyers. As mortgage rates are projected to decrease, and the population continues to grow, increased demand relative to supply could lead to renewed growth in home prices.

TRREB CEO John DiMichele emphasized the importance of addressing housing affordability through policy decisions, including recent positive changes allowing insured mortgage holders to switch lenders without the stress test. Advocacy for a consistent approach to uninsured mortgages and the necessity of increasing housing supply remains a key focus for sustained positive momentum in the GTA real estate market.

In summary, the GTA real estate market emerges with resilience and strategic initiatives, setting the stage for a thriving and accessible real estate landscape.

Should you desire a thorough analysis and tailored guidance, do not hesitate to contact our team. Your dream home in the GTA might be closer than you think.